[t4b-ticker]

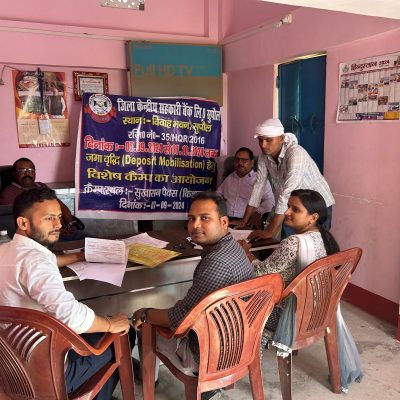

Co-operative Bank

The Co-operative Bank is a type of financial institution that is owned and operated by its members (customers). It follows the principles of cooperative governance, meaning profits are often reinvested into the bank or distributed among its members rather than external shareholders.

Key Features of Co-operative Banks:

- Member-Owned: Customers are shareholders and have a say in decision-making.

- Focus on Community: Often serve local communities or specific groups.

- Lower Interest Rates: Tend to offer better loan and deposit rates than commercial banks.

- Regulated by Authorities: Subject to financial regulations depending on the country.

- Profit Reinvestment: Earnings are used for the benefit of members or community initiatives.

OUR SERVICES & PRODUCT

Saving Account

A savings account is a type of bank account that allows you to deposit money, earn interest, and withdraw funds while keeping your money safe. It is ideal for building emergency funds, saving for future goals, or simply keeping cash accessible while earning interest.

Key Features of a Savings Account:

- Interest Earnings – Banks pay interest on the money in your account, though rates vary.

- Liquidity – Easy access to funds, though some banks may limit withdrawals per month.

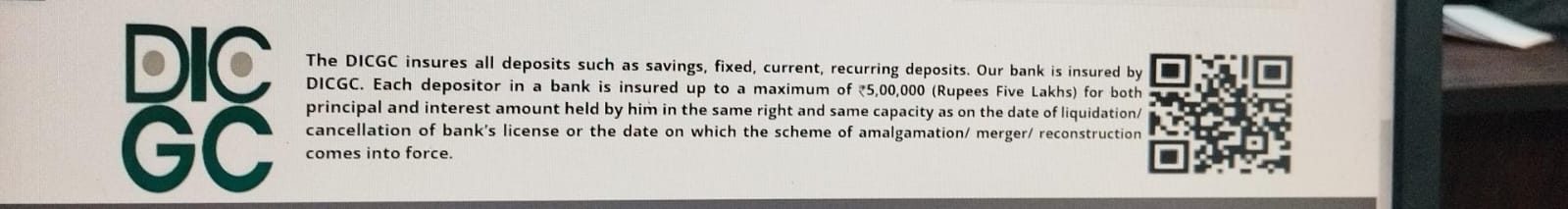

- Security – Insured by government agencies (e.g., FDIC in the U.S.) to protect deposits.

- Minimum Balance Requirements – Some accounts require a minimum balance to avoid fees.

- No Fixed Maturity – Unlike fixed deposits, there’s no set term for withdrawals.

Types of Savings Accounts:

- Basic Savings Account – Standard account with a low minimum balance and moderate interest.

- High-Yield Savings Account – Offers higher interest rates, often found at online banks.

- Money Market Account – Hybrid of savings and checking, usually with a higher interest rate.

- Certificate of Deposit (CD) – Fixed-term savings with higher interest, but limited withdrawals.

- Kids/Minor Savings Account – Designed for young savers with parental oversight.

How to Open a Savings Account:

- Choose a bank or credit union.

- Compare interest rates, fees, and features.

- Provide identification (ID, Social Security Number, etc.).

- Deposit the required minimum amount (if applicable).

- Set up online banking and link to other accounts.

Current Account

A current account is a type of bank account designed for businesses, professionals, and individuals who conduct frequent transactions. It allows for unlimited deposits and withdrawals, making it ideal for day-to-day banking needs.

Key Features of a Current Account:

- No Transaction Limits – Unlike savings accounts, there are no restrictions on deposits and withdrawals.

- No Interest Earnings – Most current accounts do not offer interest on deposits.

- Overdraft Facility – Banks may allow account holders to withdraw more than their balance (subject to limits and fees).

- Business-Friendly Features – Provides facilities like checkbooks, demand drafts, online banking, and bulk payments.

- Higher Minimum Balance Requirement – Banks may require a higher minimum balance compared to savings accounts.

Types of Current Accounts:

- Basic Current Account – Standard account with essential banking features.

- Premium Current Account – Offers additional benefits like free transactions, cash management services, and higher overdraft limits.

- Foreign Currency Current Account – Designed for businesses that deal with international transactions.

- Packaged Current Account – Comes with extra perks like insurance, special offers, or concierge services.

Who Should Open a Current Account?

- Business owners and entrepreneurs

- Self-employed professionals (e.g., doctors, lawyers)

- Large organizations and corporations

- Freelancers and consultants with regular financial transactions

How to Open a Current Account:

- Choose a bank that fits your needs.

- Submit required documents (ID proof, business registration documents, PAN card, etc.).

- Deposit the required minimum balance.

- Activate internet banking and other services.

Fixed Deposit

A Fixed Deposit (FD) is a secure investment option offered by banks and financial institutions where you deposit a lump sum for a fixed period at a predetermined interest rate. It is ideal for individuals looking for a low-risk way to grow their savings.

Key Features of a Fixed Deposit (FD):

- Guaranteed Returns – Earns a fixed interest rate, unaffected by market fluctuations.

- Flexible Tenure – Can range from a few days to several years (usually 7 days to 10 years).

- Higher Interest Rates – Generally offers better returns than a regular savings account.

- Premature Withdrawal Option – You can withdraw before maturity, but a penalty may apply.

- Loan Facility – Some banks offer loans (up to 90% of FD amount) using FD as collateral.

- Tax Implications – Interest earned is taxable, but tax-saving FDs (5-year lock-in) offer deductions under Section 80C of the Income Tax Act in India.

Types of Fixed Deposits:

- Regular FD – Standard fixed deposit with flexible tenure and interest payout options.

- Tax-Saving FD – 5-year lock-in period with tax benefits under Section 80C.

- Senior Citizen FD – Offers higher interest rates for individuals above 60 years.

- Recurring Deposit (RD) – Allows small monthly deposits instead of a lump sum.

- Flexi FD – Linked to a savings account, allowing automatic transfers based on balance.

How to Open a Fixed Deposit:

- Choose a bank or financial institution.

- Select the FD tenure and interest payout option (monthly, quarterly, or on maturity).

- Submit required documents (ID proof, address proof, and PAN card).

- Deposit the desired amount via online banking, check, or cash.

- Receive an FD receipt or certificate as proof of investment.

testimonials

Customer Testimonials about a specific Co-operative Bank

Address

- 1st floor Sarkar Bhawan, Ward No -09 Lohiya Nagar Supaul. Pin- 852131

- +91 +91 7979948052

-

contact@dccbsupaul.com

dccbsupaul@gmail.com

Social Networks

- insta_account

- plusprofilename

- username